Second Charge: Unlocking Second-Life Potential of EV Batteries

India’s National Critical Mineral Mission aims to secure a steady supply of critical minerals to ensure that the nation achieves its net-zero emissions target by 2070. As India transitions to low-carbon technologies, lithium-ion batteries (LIBs) — which depend on critical minerals such as lithium, cobalt and nickel — will be instrumental in powering electric vehicles (EVs) and energy storage systems. But once these batteries degrade, how can we maximize their remaining value?

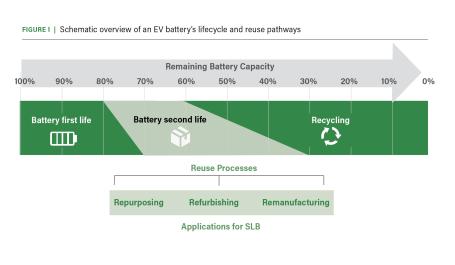

When LIBs used in EVs degrade by just 20%-30%, they become unsuitable for primary EV applications. However, the remaining 70%-80% energy storage capacity can still be harnessed through repurposing, refurbishing or remanufacturing (Figure 1). This can extend battery life from four to eight years to as much as 10 to 15 years.

With EV adoption projected to rise, the demand for LIBs is expected to reach 381.4 gigawatt-hours (GWh) between 2022 and 2030, resulting in a potential 49.2 GWh market for second-life batteries (SLBs) from retired EV batteries. By reusing these batteries, India can reduce its reliance on imported LIBs and advance a more circular economy.

Emerging Second-Life Battery Market

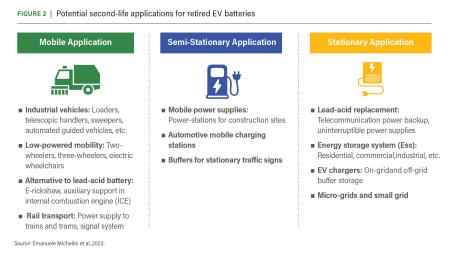

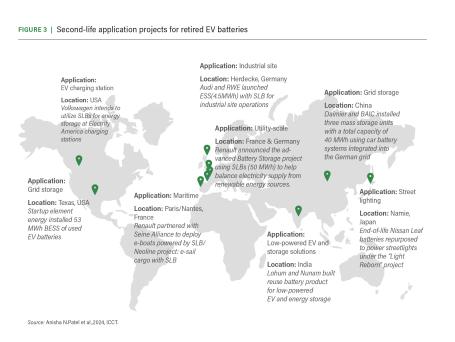

As second-life applications (SLAs) gain traction, a robust market is emerging globally and in India, spanning mobile, semi-stationary and stationary storage solutions (Figure 2). This growing adoption not only enhances resource efficiency but also opens new business opportunities, with the global SLB market projected to reach $9.93 billion by 2031.

In India, SLAs are advancing through global collaborations and domestic innovation. Global original equipment manufacturers (OEMs) like Audi and Mercedes-Benz are working with Indian companies such as Nunam and Lohum to repurpose retired EV batteries for energy storage. JSW MG Motor’s Project REVIVE is enabling industrial-scale SLB solutions with Lohum, BatX and LICO materials. JSW MG has also introduced India's first high-voltage SLB, in partnership with Vision Mechatronics, featuring an indigenously developed battery management system (BMS). Similarly, Zipbolt innovations in collaboration with Mercedes-Benz has diagnosed and deployed over 50 repurposed battery systems for swapping in e-rickshaw and electric scooter.

Challenges to Scaling Second-Life Battery Applications

Despite their promise and growth, second-life battery applications face a range of commercial, technical and policy challenges that limit widespread adoption (Figure 4).

Graphic by Abhishek Meshram and Safia Zahid/WRI India.

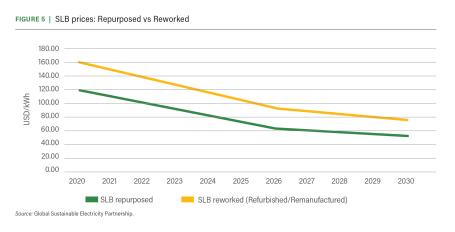

Falling new battery prices are undercutting the SLB market’s cost advantage. New battery pack prices fell by 20% to $115 per kilowatt-hour (kWh) in 2024 and are expected to drop further. This narrowing price gap reduces the cost advantage of SLBs, making them less competitive unless repurposing costs can be significantly reduced.

A study by the Global Sustainable Electricity Partnership found that repurposing — as opposed to refurbishing or remanufacturing — is the most cost-effective second-life pathway, as it avoids high expenses associated with repair, dismantling and component replacement (Figure 5).

Standards and Policies Enabling SLB Adoption

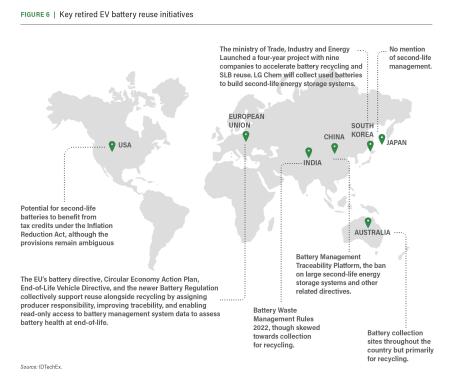

Governments across the world are adopting policies that promote battery reuse and recycling to support a circular economy (Figure 6). In India, the Battery Waste Management Rules 2022 introduced extended producer responsibility (EPR) across the battery value chain, with refurbishers formally recognized for the first time. Although the framework currently emphasizes collection for recycling, it opens avenues to expand reuse with the right technical guidelines around safety, liability and quality assurance — critical prerequisites for commercial SLB deployment.

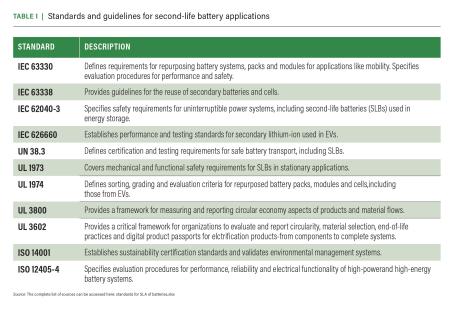

Across markets, emerging standards are creating a common technical language to assess SLB quality and lifespan (Table 1). These are vital to address information asymmetries in resale markets and to de-risk projects for financial institutions, making second-life battery applications more attractive for commercial deployment. However, India currently lacks specific standards for SLBs, a critical gap that must be addressed to improve commercial feasibility.

Way Forward

To unlock the full potential of second-life batteries in India, a coordinated approach that establishes robust regulations, expands testing and certification infrastructure, and promotes circular-friendly battery designs is essential. Building a digital ecosystem, such as a battery passport, can enhance traceability, reduce costs and enable lifecycle management. Additionally, business model innovation and supportive financing mechanisms will be critical to accelerating market adoption and ensuring economic viability.

Key Actions

- Establish clear guidelines for the safe handling, repurposing and remanufacturing of batteries, including quality benchmarks and standardized operating procedures.

- Make certification affordable and accessible, especially for micro, small and medium enterprises (MSMEs) and refurbishers.

- Promote modular battery designs that simplify reuse and remanufacturing, making them cost-effective.

- Develop India-specific battery passport solutions to improve traceability and data access, potentially reducing procurement (2%-10%), testing (up to 10%) and recycling (10%-20%) costs.

- Prioritize reuse over recycling to maximize value recovery and minimize waste, supported by collaborative business models and financing mechanisms that de-risk investments and drive adoption.

India’s second-life battery story is just beginning. The pieces are in place, and the opportunity is clear. Policy, innovation and partnerships must now come together to shape a market that is not only circular but also scalable and ready to power India’s clean energy future.

Lalit Mudholkar and Abhishek Meshram are former Junior Program Associates and Swati Pathak is a former Senior Program Associate from the Electric Mobility team, WRI India.